If you’ve ever had to send or receive money in the US, you probably have an idea of how complicated it can be. There are a ton of different ways to go about it and they all have different fees, transaction times, and security considerations.

This is due to the way US banking infrastructure works and how it was set up a long time ago. All of these payment rails are implemented on top of a complex, fragmented underlying system, where each transfer type work with certain processes and ways to handle things.

To make it even more complicated, each transfer type is branded by the operator, and knowing what each of the acronyms means adds to the effort of regular people, who just want to send their money from A to B.

Let’s try and unpack how it all works so you can make more informed decisions about how to move your money.

Understanding US banking infrastructure

We'll start by taking a quick look at how this underlying layer works so we get a better understanding of the payment systems that work on top.

For centuries, banks have been the primary way for individuals to transact with each other. They act as a third party that keeps a ledger of the transactions that happen between two or more parties.

The way they’ve done this is by keeping accounts for each party and making sure that when funds are transferred, Account A gets debited and Account B gets credited. Historically, this saved individuals the trouble of carrying around gold or other previously popular forms of currency to settle their business.

But what would happen when Account A’s funds were held by Bank C in Iowa, and Account B’s funds were held by Bank D in Connecticut? This was when banknotes became a thing.

Banknotes were documents issued by banks as a substitute for physical currency and backed by a specific bank’s reserves. They simplified transactions by letting other banks know that they were good for Account A’s funds and then they would settle things between themselves.

Of course, this method had its drawbacks and risks. As bank notes became popular, most countries had to establish central banks (or the Federal Reserve in the US) to supervise and regulate the issuance of bank notes.

These central banks became a sort of single ledger where all accounts were settled across banks… sound familiar?

Fast forward to today, banknotes are no longer the most popular way for banks to settle customers’ accounts between themselves. Most of these processes are now handled electronically — thankfully. But this has presented challenges of its own.

All payment systems are solutions to this problem of how to get different institutions to communicate with each other effectively and securely. There are organizations like The Clearing House that are dedicated to taking care of the details of how to best implement the appropriate systems.

Major payment systems

In fact, The Clearing House maintains two of the most widely used payment systems that are able to navigate the complex infrastructure in the US according to Federal Reserve regulations.

Automated Clearing House (ACH)

The Automated Clearing House was the first electronic solution to account settlements between US banks developed in 1972. The system takes care of processing large batches of transactions between different banks and settling them with the Federal Reserve, all in through the sharing of secure electronic files.

Due to their volume, ACH transactions typically take one to two business days. This makes them suitable for use cases that are not time sensitive such as payroll or vendor payments. Likewise, ACH is very low-cost, and by far the most widely supported transfer type in the US.

Besides the obvious drawback of long settling times, ACH is also reversible, which creates a lot of uncertainty for the receiving party and is also at a higher risk of fraud.

Real-time Payments (RTP)

In 2017, The Clearing House introduced an alternative to the ACH payment system in the form of a Real-time Payments network. It works around the clock, and the operator claims that RTP transactions settle in just seconds.

The solution has been growing steadily ever since and now over 61% of US banks support RTP for demand deposit accounts (DDAs).

RTP is ideal for time-sensitive transactions such as bill payments as well as peer-to-peer or business-to-business transactions. Just like ACH, RTP offers low-cost transactions, with the added bonus of being irreversible.

Other payment systems

However, ACH and RTP are not the only payment systems that are used today. Services such as wire transfers, peer-to-peer payments, and others are also widely used.

Wire

Wire transfers fulfill a similar need to ACH and RTP transactions. The difference is that, while ACH and RTP happen through an operator or clearing house, wire transfers are handled directly by the bank. Wire transfers are arguably the most widely available payment method.

Once a bank has the necessary information for the other party’s account on a different bank, it proceeds to debit the sender’s account and credit the recipient.

All of this can take place within hours when processed domestically and up to 3-5 business days when processed between international banks - but depending on the case, it may take up to three weeks.

Besides the long processing times, wire transfers are significantly more expensive than ACH or RTP, costing up to $50 for international transfers. Yikes.

Peer-to-peer (P2P) payments

Then we have platforms, like e-wallets, that allow individuals to transfer funds between each other using mobile phone applications or websites. This form of electronic payment system was pioneered by PayPal in 1998 and other companies like Venmo and Zelle have introduced iterations on the concept since then.

These services work as a payment layer built on top of the banking system where they settle transactions instantly between users within their own platforms.

In these cases, users deposit funds from their banks into their digital accounts. The company then takes care of finalizing their ensuing transactions instantly within their internal databases depending on the amount of funds users have credited to their digital accounts.

P2P payment solutions have become increasingly popular for small transactions between friends and family because of their low-cost and instant settlement. However, availability depends on both parties holding an account with the same platform - which isn’t always the case.

FedNow

The Federal Reserve is about to release its own alternative to The Clearing House’s RTP system for instant payments in the form of the FedNow system. Expected to launch still in July 2023, the new system will have similar functionalities to its counterpart.

However, it should be noted that FedNow is not meant to compete with RTP directly. It’s expected to focus on serving smaller community banks and will even become interoperable with ACH.

Likewise, there is some speculation that the system could be the Federal Reserve’s infrastructure prototype for a Central Bank Digital Currency (CBDC).

Ramp Network and the future of payment systems

Obviously, here at Ramp Network we believe that the future of payments will be very different from all of these options with the rise of web3.

While ACH, RTP, wire, and P2P have served a purpose in the past, they still rely on a fragmented, proprietary, sometimes clunky banking infrastructure, and with very little - if any - reach outside the United States’ borders.

Quicker, cheaper, and truly global payments are only a few of the many use cases that are possible with crypto and web3.

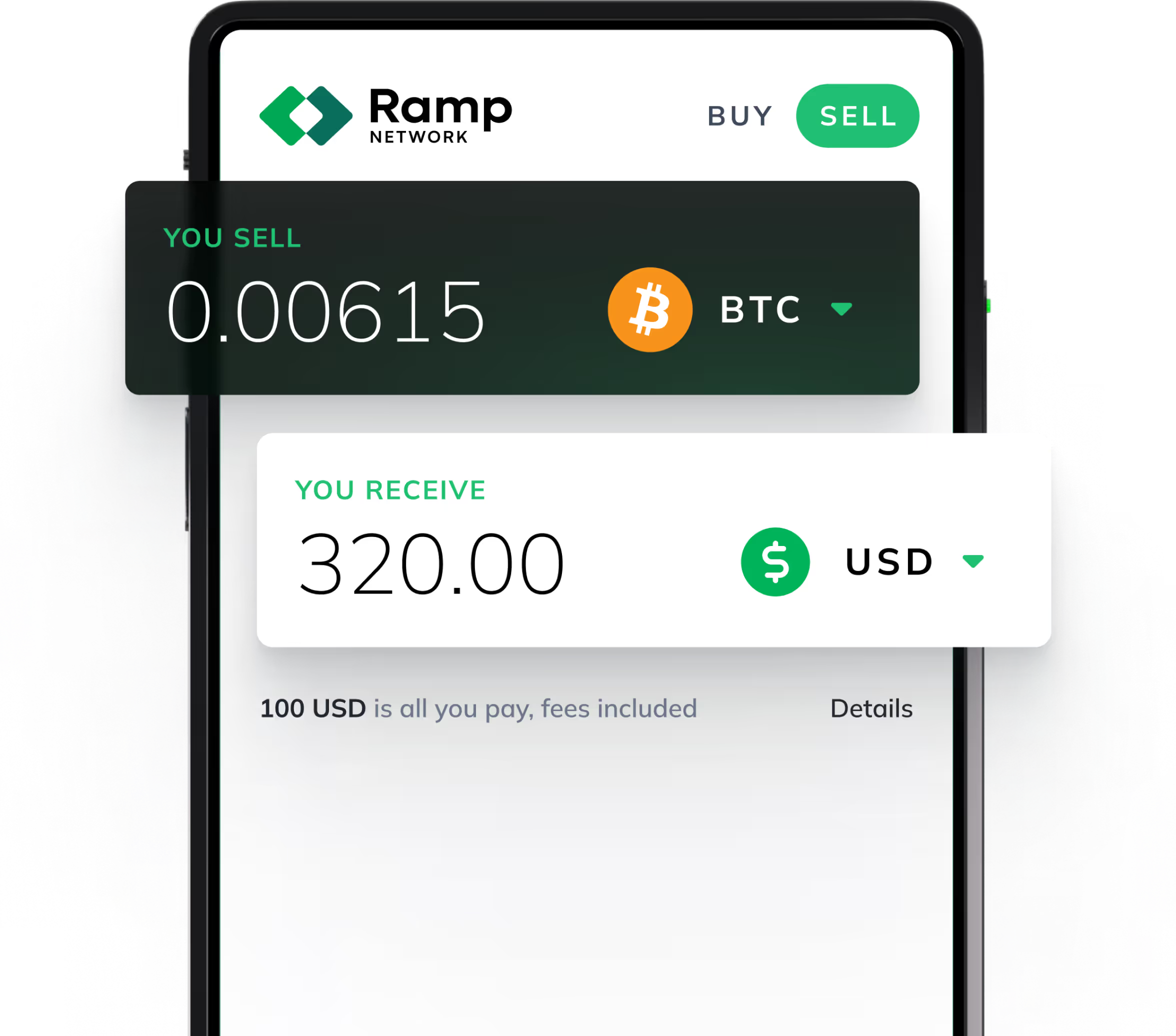

We’re paving the way for this future by making it easy to jump back and forth between these existing systems and the decentralized, permissionless, and programmable infrastructure of the future.

Ramp Network accepts both ACH and RTP in the US for our crypto on-ramp. We’re also constantly working on adding more options to make crypto accessible to anyone, anywhere.

Check out our accepted payment methods and how they work within Ramp Network (including a look at when you can use RTP), and buy crypto now to join the crypto revolution!

You might also be interested in:

.png)