Brazil is a powerhouse with one of the fastest-growing global rates of crypto adoption, and it has been taking a leading role in crypto regulations both in Latin America and the world.

We invite you to check out this feature conversation we had with a few leading minds in Brazil when it comes to BUIDLing the new web. Watch the video below, or follow this link to watch it on YouTube.

For the more avid readers, keep scrolling for a full transcript of the talk.

Our panelists

- Aaron Stanley is a former Coindesk journalist and the founder of Brazil Crypto Report, a weekly newsletter on crypto developments in Brazil.

- Alex van de Sande is an Ethereum Foundation alumni who played a role in some of the ecosystem’s most formative moments, as well as a co-founder of ENS - the Ethereum Naming System.

- Juliana Walenkamp is director of institutional sales - LATAM for crypto custody giant BitGo, former Gemini and Ripple, and founder of Alma DAO.

- Szymon Sypniewicz is co-founder and CEO at Ramp Network.

- Thiago Earp is content lead at Ramp Network.

Transcript

Thiago (00:05:48):

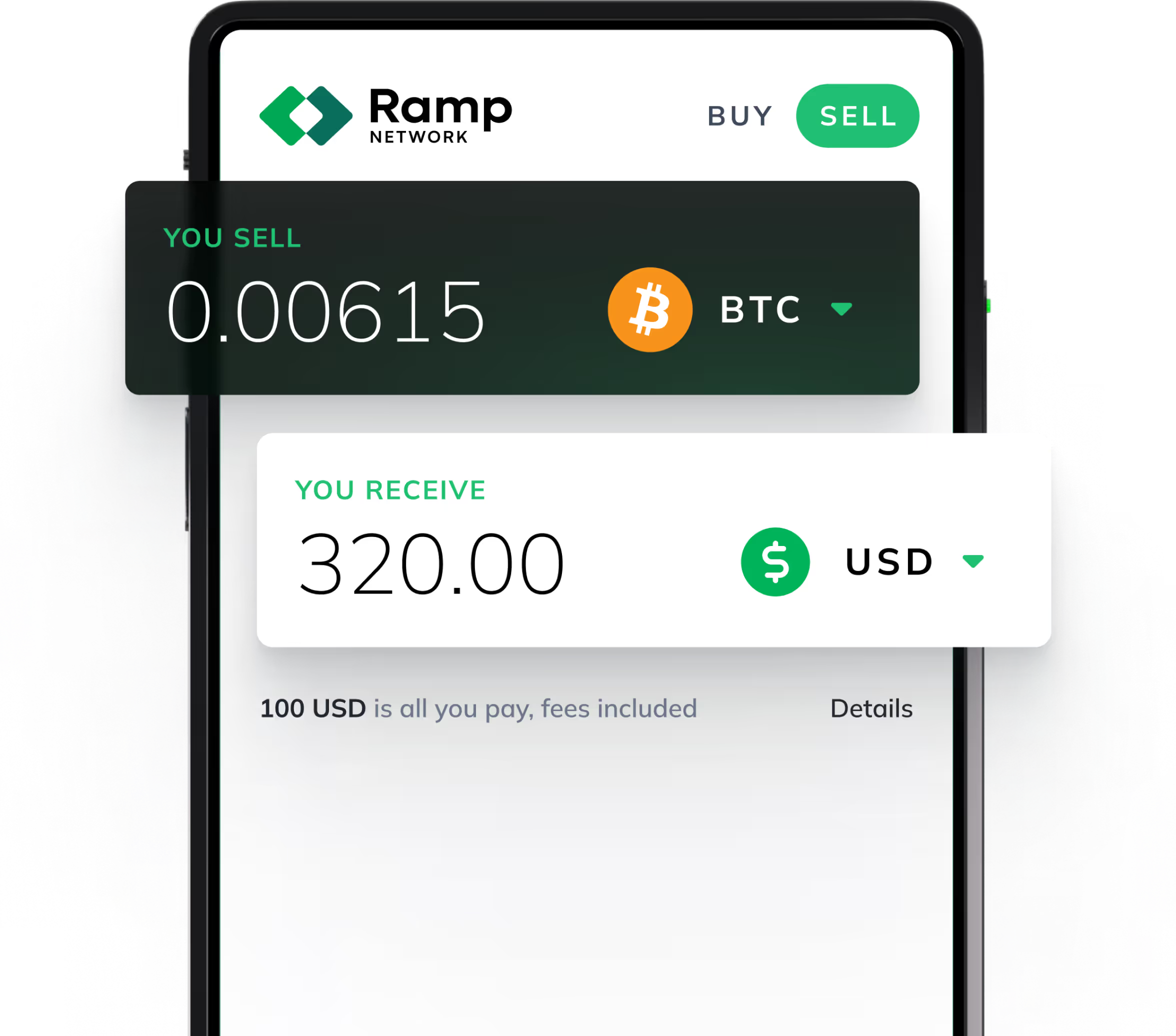

I think first of all, thank you everyone for accepting the invitation. Thanks for coming here for this conversation. Let's begin. I'll start by giving a quick intro about Ramp Network and then we can move on to introductions before we get started with the main topics for today. So at Ramp Network we're building the infrastructure to connect Web3 with today's global financial system. Our on and off-ramp product line provides both businesses and individuals with a smooth experience for converting between fiat and crypto. So it's an on and off-ramp. Our mission is to make Web3 accessible to everyone and everywhere. So I might be slightly biassed, but we've been following the growth of Web3 in Brazil for a while and it's been quite a remarkable evolution rate. For the past years and even the past months, we've been working to boost our support to Brazilian users.

(00:06:42): We've opened a Brazilian entity, we've added support for Pix, and we really believe that this is just the beginning into our foray in Brazil and collaboration. So today the idea is to open yet another door into Brazil and we'd like to hear from you and learn from your experience and share a bit of the Brazilian flair to doing web3 with our audience and with the world. So in terms of introductions, I'll start. I'm Tiago Earp, I'm Content Lead at Ramp Network and I'll be moderating this conversation. And with that said, I'll ask each of the guests to introduce yourself. So starting with Aaron, if you can introduce yourself please.

Aaron (00:07:26):

Yeah, absolutely. Thanks so much for having me here. Really excited to be here. Appreciate the invitation. So I'm a gringo, I'm an American living in Brazil. I'm sporting my Brazil jersey here, but I was going to wear my Flamengo jersey, but that might cause too much controversy. So just stick with the national team here. So I'm a career journalist slash media guy. I started my career for a few years with the Financial Times in Washington, DC. Ended up kind of falling down the Bitcoin rabbit hole I guess in maybe 2013 or so. Ended up working for years at CoinDesk. I was a reporter/editor there. Ended up running content for Consensus, the flagship conference. And a couple of years ago I started up this Brazil crypto report project just with the thesis that it's just a massive market here and there's literally no English language resources anywhere on this market and just figured, hey, this is maybe something that there's a need for. So I started doing this, I've got a newsletter podcast, YouTube expanding this out a bit more in the next couple months to provide a bit more coverage and in-depth research on different areas of the Brazilian market and just with the thesis that this will probably be one of the key markets for crypto, web3, digital asset growth. Moving ahead here.

Thiago (00:08:53):

Thanks Aaron. Maybe let's go in the alphabetic order. Let's go on with Alex now.

Alex (00:08:59):

Hi everyone. Okay, so my name is Alex Van Sande. I am a Brazilian, despite gringo sounding name. I joined the Ethereum Foundation in 2014. So if you're counting making the account, that's before even the network had launched. There, I led the design of the first EUI wallet the foundation put out, which was also the first wallet to support ERC tokens, which is a standard we wrote inside our team, the first wallet to support lots of other standards like the checksum-ing addresses. Then we attempted to do a decentralised browser. We also launched ENS inside the Ethereum Foundation. It was supposed to be just another UI feature to help you recognise names. And then ENS eventually came out of, became independent of the Ethereum foundation, became its own DAO, launched its own token and it's a whole giant thing that fire supports anything that the original wallet and browsers ever did. So that's it I left the Ethereum Foundation about in 2018 and I've been doing lots of crypto stuff since then.

Thiago (00:10:33):

Thanks Alex. Let's introduce Juliana then.

Juliana (00:10:38):

Hey guys, very nice to meet you. Thank you so much Thiago for the invitation. Thank you Ramp Network for the opportunity to be here with everyone for this discussion. So my name is Juliana Walenkamp. I have been working in the crypto industry for the past seven years now. I have experience with different crypto solutions. For example, payment gateway, OTC, trading and negotiation, and investment fund with a one hundred percent exposure to crypto. The creation of a Brazilian stablecoin also affects using crypto as the underlying asset launch of exchange. And now I'm on the infrastructure side working with everything related to custody, wallets, staking, NFTs, white label, et cetera. So I worked at Ripple, Gemini and now I'm at BitGo responsible for Latin America based in Brazil. I'm also Brazilian and I help some companies as advisor for web3 projects.

Thiago (00:11:36):

Thanks Juliana. A pleasure to have you here. So finally, let's go with Szymon to introduce yourself, please.

Szymon (00:11:43):

Yeah, I'm pumped to be here Szymon from Ramp Network. I've started this company a couple of years ago, been in crypto since forever. And since forever I was also very frustrated about how hard it is for normal users to use crypto and the mission here at Ramp Network is to make it super easy to actually use crypto and put crypto to work. And I think a lot of that is going to be what we're going to discuss today because a lot of very exciting use cases are emerging and are pioneered in Brazil. And I'm not Brazilian obviously I'm based in London, I'm Polish. There are many interesting parallels between Brazil and Poland. So maybe we could touch on that a little bit later. And I'm just very curious. So I'm here mostly to learn. I can share some of our experience operating in more than 150 countries and how Brazil seems to be unique in many different exciting ways.

Thiago (00:13:27):

So I guess we'll start with the elephant in the room. The first thing that's catching all the headlines today is a huge surge in adoption, right? Despite the bear market, according to data from the Brazilian tax authority, there's been a massive growth in Brazilians getting into crypto for the past 12 months. I think there's been 175% increase in individuals and 181% as represented by CPS and CNPJs and people dealing with crypto according to fill that out. So I'd like to pose this question to you, all of you. And I guess I'll start by picking somebody and then everyone can give a perspective about it. What is driving this growth and what is the potential? What are the potential consequences for such fast rate of adoption? So I guess I'll start with Juliana.

Juliana (00:14:22):

Yeah, pleasure. So I believe that Brazil is acting as a great role model globally in the blockchain market. And I think that this has advanced on a few different fronts. So firstly for social economic reasons, we had the retail buy-in from the very beginning. It was very significant when we saw the number of CPFs which means, the number of people really going to exchanges and buying Bitcoin, Ethereum since 2016, 2017. Because of that we have a big financial education problem that has been changing over the last few years. And at first Bitcoin was seen primarily as an alternative asset for investments which came with the promise of huge gains. At the same time, I mean local companies such as MercadoBitcoin, FoxBit was really working towards bringing more reliability to the market and serious structure to bring education, more context about what the market is about and also new solutions that the Brazilians were not used to in the past.

(00:15:38): In parallel, we have also an extremely advanced central bank in Brazil with agendas very open towards innovation disruption and aimed for technology like we see Pix as the main example for that. And with the regulator movement and with greater clarity, institutional market also was coming in. So when for example big banks, big financial players were looking at crypto at the very beginning, they were scared because it was lacking information, lacking context and basically clarity about what the market was about. So there was a lot of misunderstandings if it was pyramid schemes, if it was bubbles, et cetera. What we need to understand is that this technology, it's a solution that can bring opportunities and also answers and new products to many different niches. And the central bank really understood that. So the central bank took a step back and was working internally on his own agenda to drive on his own pace of course because regulator, but even with that he was very, very advanced.

(00:16:57): When we look basically to the global scenario right now of the crypto market and with that the institutions really started to come in either with crypto as a service offerings that are basically the buy, sell, and hold opportunity for the client to have Bitcoin, Ethereum on their wallets. Either targeting tokenization for example, that now it's a big hype in the country or a structurally formal investment vehicles for the retail or for the institutions to allow positioning in crypto. So I guess what we have in Brazil and what is leading the whole momentum, it's a mix of all these aspects. So we have the retail buy-in, we have the friendly position of the regulator, we have a local market truly looking for new and disruptive technologies to bring new solutions for society. And we have of course the internet adoption that in the whole of Latin America is incredibly high, especially in Brazil.

Thiago (00:18:07):

I guess starting up with that, there is also a question of well across the globe, one of the key issues that people claim crypto has to overcome in order to get adoption is usability. And I was wondering if, and that's a good one for Alex, he's been working in UX and crypto UX for a while. So do you think that Alex, is there any evolution in the usability of cryptocurrencies that has helped drive this adoption in the country or is there anything in terms of on the technological side that's been improving that allows the Brazilians to jump into the tech more easily?

Alex (00:18:53):

So I would say that there hasn't been great jumps in usability on crypto recently. Usability is always improving, there are better wallets and there were year ago there are easier, harder wallets were a year ago. But I would agree with Juliana that I think the Brazilian government has been a good role model for crypto, I would say worldwide because it has, since the first time the central bank mentioned crypto, they never said, look this is going to be banned, this is going to be illegal. They were just like, look, if you want to, I believe the first time the Brazilian central bank mentioned crypto, it was like, the Receita Federal just saying here's how to do credit tech, consider crypto for taxes, just consider them as jewel or gold or something like that. And that has been sort of their goal and just we are not banning it, we are just taking a look at it.

(00:19:55): We are constantly improving it and I would say that they have been inspired to enhance the financial system. I would say that Pix is probably one of the things that really has been helping because Pix basically introduce everyone to the idea of a cashless society. Pix has been a huge success. It's been, I don't think I have carried cash in my pocket for the last year and a half or something. I don't remember the last time I've met someone who did not accept Pix as a payment. So it becomes this universal thing where people understand, yeah, you can have money in a wallet, a cell phone, and it introduced the idea of key to users Pix, keys are very different. They're not private keys, there's no secret you have to take. But on the other hand I think the usability of Pix is really good because it's just using whatever your bank supports or whatever FinTech supports.

(00:21:05): You don't need to because of course everything that you picked is just a custodial API. And Brazil is now launching very soon probably launching what is essentially a national blockchain for digital for our money. They are very forward with the Drex project, which I would say is basically an Ethereum validator meant for banks not meant for end users, where the banks and financial institution would be validators and it would almost work as a base rollup where financial institutions come to agreement there and they have each one of them works as a rollup where they have their own money sent to users which use Pix and then they just settle using the Brazilian blockchain as a settlement layer. And I think that is such a positive sign to the market because suddenly now what are we going to have is a lot of private crypto wallets can convert, we'll be able to convert to Pix wallets or maybe Drex wallets. And I think a lot of the usability of Pix wallets, which is just like normal FinTech, just learn how to use a cell phone will be suddenly slowly converting into crypto. Those are merging and I think they're merging in a safe responsible manner in which yet there's nothing non-custodial, you are never your own bank, but it is using a lot of crypto advantages to reduce bureaucracy and improve efficiency into internal economy.

Thiago (00:23:00):

Alright, thanks for that insight and I guess we're earmarking the topic of government and all the government's developments in the blockchain space for just a little bit forward. But you touched on the topic of the Brazilian stable coin and how have these developments been going. Brazil has not experienced as of late a very strong inflation our CPI is still very much lower, than even the UK, however, according to the few reports lately as late as September from the Receita Federal, there still seems to be a massive portion of the Brazilian investments in crypto. The Brazilian purchases in crypto are hovering around stable coins, especially Tether. I think the figures I've seen are about 80% of the volume in July. So Aaron, with your background in financial times and everything and then your incredible research around the topic, what do you think is the reason do you think that the stable coins are, or crypto in general are offering some sort of safe haven for Brazilians? What is causing this massive inflow into stable coins in particular and crypto in general?

Aaron (00:24:30):

Yeah, it's a good question and it's a bit of a mystery in a sense. We have a lot of clues but I don't think we have the full picture quite yet. It is worth noting that because of the Pix situation that Alex was just describing where crypto as just sort of a domestic means of exchange where I'm going to pay you in stable coins instead of paying you in cash is basically there's really no value proposition for that type of use case here. So crypto is really more of like an investment use case. I think Brazilians look at it as a speculative thing. Brazilians do enjoy gambling and speculating on things. That's not exactly a novel insight, but that is one reason that we've seen a lot of interest that also there is I think this idea of cryptos being a hedge against inflation, even though inflation has been calming here in recent months and the central bank has started raising rates lately.

(00:25:29):

Brazil, I mean if you talk to any Brazilian over 30 years old, they will have intimate memories of switching currencies every two couple years, hyperinflation, all those sort of things. So hyperinflation is something and also we see what's happening in Argentina so we do understand that or Brazilians do understand that this is a thing that could return at any point. As far as stable coins, specifically the tether usage, if you look at the stats for this most recent month of July, tether constituted about 82% of the entire crypto trading volume for the month. The total volume was about 4 billion in dollar terms, tether was about 80% of that. And then USDC was another, I'm not sure of the percentage figure, it was about 750 million if I recall correctly. So you're looking at stable coins accounting for about 90% of the total volume of transactions reported to the Receita Federal, which is like the Brazilian IRS tax authority basically. And if you look at the average transaction size for Tether, it was about $13,000 for the average transaction size. And this is not like okay: "I'm going to send some money to a friend in another country" type of operation.

(00:26:52): I think there's much more of a commercial use case going on here. I think a lot of it is importers. I think this is a way for importers to be able to get money out of the country quickly in batch sums. I think, I'm not entirely sure exactly who or how they're doing this, but the uptick in stable coins has in usage on this area I think has been pretty pronounced. And then I mean that said, going back to the previous question about just overall adoption, I think you do have the number of FinTech apps that have been rolled out in Brazil that are offering crypto as a service products now like Newbank and pay and these kind of FinTech apps that everybody uses has been a major reason for just the sheer ballooning and the number of people that are reporting crypto now. So for an example, when Nu mbank launched their crypto product offering last summer or summer of 2022, they had a million users within three weeks because they already have 40, 50 million users of their wallet. And all of a sudden, okay, now you have crypto offerings and people can buy as much as a minimum of one hangout, one basically 10 cents worth of Bitcoin and boom.

(00:28:16): Another reason that we've been seeing this influx or this increase in the number of people reporting transactions is I think there's just been a lot more pressure being put on overseas exchanges where there's not as much, I mean basically technically everybody who's trading crypto in Brazil is generally you're supposed to report this to the government and the domestic exchanges are actually required to report that to the government. But if you're trading on a Binance or a buy bid or something, those exchanges aren't necessarily complying a hundred percent with the full letter of the law. So you don't necessarily have to, or I'm not trying to cast aspersions to anybody, but there's overseas exchanges that people are using that the reporting requirements are not as strict as using domestic requirements. But there's been a bit more of a crackdown on people using some of these exchanges and the IRS or the Receita Federal has been going around really trying to lay down some of the rules and the expectations that like, hey, just because you're trading on over exchange doesn't necessarily mean that you're scotch free forever.

(00:29:28): We might come find you and you're going to have to pay taxes on this eventually and it's going to be. So I think you're getting an increase in number of people reporting that may not necessarily mean that there's more people trading. I mean I suspect that it does mean there's more people, but it may not necessarily mean that it may just mean there's more people coming out of the grey market into the more regulated market. But I do think that the number, just the uptick in numbers and volume amid a bear market indicate is a very positive indicator irrespective

Alex (00:29:59):

So Aaron mentioned how Brazilians like gambling and I think that might be one of the things, but I would like to answer that and I think I would disagree a little bit. Yeah, of course there's gambling, there's a gambling aspect of crypto, but I would say that's universal. Every country has it. I wouldn't say that Brazilians like gambling more than other countries. And also that contradicts the fact that the data you just mentioned where 90% of usage is in stables and we're mentioning inflation. But yeah, of course all Brazilians over 30 grew up have a trauma carrying of the fear inflation coming back. We have inflation but it's not as huge as it used to be, but a lot of it is just escaping the real, right? It's just having a safe haven in the dollar a little bit, just making sure that not all your finances are in the real and just having a little bit of dollars. I also say it's interesting that you mentioned that most transactions are over $13,000 because it might be a coincidence, but that's close to the requirement amount that the Receita asks that over that amount you have to pay more taxes. So I would suppose that there are a lot of underreporting of just people buying small amount of just USDC or Tether just to make sure that they have non-real backed currency because more than the fear inflation, it's also the fear of the real being devalued as a general thing. Right?

Thiago (00:31:53):

Yeah, that's a very good insight. Hedging against the real is something that I think I myself I know all too well having moved from Brazil and watching how it kind of fluctuates wildly so yeah I can relate to that. But I think you touched on the bringing people from the grey area and into a more compliant and open way. It is kind of responsible in part for this growth and the thing, it's something that we've been seeing a lot lately as compliance and regulations have been catching up, not just in Brazil. Brazil's been assuming quite a leading role in that but not exclusively. And I think you could jump in here and give it a global perspective of how is that out outside as well and how you see it in the compliance also from our experience in Brazil and why we moved into the country.

Szymon (00:32:49):

So first of all, before I go there, I think that we should remind ourselves that crypto is not just about speculation and being gambling tokens. And I think that many people today would be and should be discouraged from buying crypto just to gamble a little. I think that crypto increasingly is a hedging mechanism and what could be the lesson from the data we're looking at concerning Brazil, but also many other countries where stable coins are more and more popular. And I think that globally stable coins really shoot up as in general means of exchange. I think that many people are looking to get exposed to more stable currencies even if their respective markets and economies are doing very well, right? So CPI index in Brazil is below 5% today, which is remarkably good and better than many European countries for example, where I come from.

(00:34:01): And so on the regulatory front, I think that our experience with Brazilian regulations was really, really good. We think that's, these rules are very clear and by being clear, these are very accommodating and helpful in doing business. We found it quite refreshing. We operate on many markets and we are regulated or pursuing licences in many countries and our experience with Brazilian regulations was and is remarkably good. We operate locally and we plan to get our own licence in due course as now crypto licences got announced in Brazil as something coming relatively soon. But I just wanted to say that Pix apart from setting a standard for how digital cash is working and helping people to comprehend the ways of working of crypto which are on UI level pretty similar. I think it also means that buying crypto is so much easier, right? Pix is instant, it is very hard to reverse the transaction or charge back one QR code is all it takes to initiate a payment.

(00:35:24): And I think for many people this means that buying crypto became refreshingly easy and this is also something we're benefiting from at Ramp Network offering Pix in Brazil and we saw overnight 90% of our users shifting from buying with debit cards in Brazil to buying with Pix, which demonstrates how big of a UX difference there is between other payment methods and Pix. So I think Pix might be helping here as well, not only on a conceptual level but also on a very real mechanistic level of how am I going to pay for this? Oh there is Pix, that's great, not reversible instance and very easy to set up as a payment methods. Great, I'm going to pick that. And then on all of the governments and countries around the world picking up the pace and catching up with recent crypto advances, I think that the Brazilian way was and is something to admire and I think many countries could look at that and take clues because I think it is very reasonable.

(00:36:41): And at the same time there were no, so far, there were no instances of regulations that would just raise eyebrows. I cannot call out individual regulators, but some of the regulators we deal with can at times just act in a way that seems very rushed and sometimes their decisions are surprising and hard to comprehend. And I think in Brazil everything is much more well thought out on the regulatory level, which we very much appreciate. And I think it just takes a stand to how Brazilian central bank is far ahead, many other regulators around the world in their thoughtfulness around encouraging and regulating new financial phenomena, speaking broadly. So we are very, very happy to be part of that and take advantage of it.

Thiago (00:37:46):

Thanks Szymon. I think it's a good time to take the cue and move on the conversation to government. As we've all noted in a way or another the Brazilian government seems to be on the friendlier side when it comes to the adoption of blockchain technology and even crypto to an extent and even an early adopter amongst nations. Some examples include, as you mentioned Drex and recently just last week released a blockchain based identity national identity card. So it appears that Brazil, the government is actually setting up its own decentralised network even though the permission systems. So I guess the question is open and I'd like to hear all your points of view about how do you see the rise of these government led permission systems playing out alongside the open networks that we know and love such as Ethereum, Bitcoin, how is that dynamic going to play out in the future in Brazil or how do we envision that happening? Is that going to interfere? Is that going to clash in any way or is it just going to reinforce it? And I'll leave the floor open and I'd like to hear from all of you actually.

Alex (00:39:03):

Okay, so I think it'll be an interesting experiment. I think in one hand that has been always my goal with crypto and my hope of crypto is that it's used to help the transparency of public funds and to help for governance. I've always been more interested in the governance aspect of it than on all the other aspects. I think crypto has its way, crypto has been painted as a politically right wing for the last few years, but I think since the beginning it's always been a Rorschach Test where you can see whatever you want in it. And I think nothing tells that better on the possibility of just using it as a transparent and democratic way of making sure that funds are spent the right way. I remember giving presentations in 2015 2016 where I could just, I would deploy DAO live on main net during a presentation and make a transfer and a vote and say, hey, just a hundred lines of code I made a democracy and a congress that cannot be where you have no way of taking the money out without properly following the procedure, without having a proper vote to it.

(00:40:29): And I think that's still as beautiful an idea to me now, as it was seven years ago. And I do hope that that's where we go with it in which more public funds are managed in a transparent manner and that everyone can follow. Of course the risk is that public funds keep becoming a black box and what happens is that every single transaction by individual becomes transparent to the government and then they can just block anyone from doing any private transaction. And I think that is a danger that we need to be, to be careful. I think that the Drex team, I've spoken with members of the Drex team and I think that they are aware of the discrepancy and what they're trying to do is not to create, to grant new brand new power, so the government, but rather to replicate existence system on chain in which it's not the government who has direct information on users, it is financial institutions who run validators who have that information. In order to get that information you still have to go to a court system to request a warrant on a financial institution and then that financial institution would review the information that they currently own. So I think they're trying to find interesting balance there and I think I'm optimistic with that. I'm cautiously optimistic with the way that they're trying to do.

Aaron (00:42:08):

I was just going to say I agree with that. I think to me the direct, which is basically the wholesale CBDC project that the central bank is developing here, it kind of represents the most interesting merger of, I dunno, I guess we'll say the open permissionless crypto that we all know and love and then more of a traditional tradify ecosystem that's really implemented at a scalable level. And I think they've, to echo Alex's point, I think that the central bank has done a good job of really trying to go to first principles on what values do we want to really embed in this system. I mean they've actually delayed some of the implementations and some of the timelines for rolling this out because they felt like they didn't have an adequate, sufficiently adequate privacy solution in the tech stack essentially.

(00:43:10): So just the fact that they're delaying it for that reason alone is like, wow, okay, this is something that they really value. I think there's some of these crypto native values that are being embedded into the design of the project, which I think is quite interesting and encouraging when we're trying to balance the values of crypto with some of the benefits of traditional finance. And I do think that especially as, at least in my view, I feel like the future of, I mean we'll call it unregulated defi, the future of this just seems kind of uncertain right now just given some of the court actions in the US and it's uncertain of, it feels like all this stuff is going to continue existing, but how many people will actually be able to use it at scale. And I think a lot of these protocols like your AAVEs and your uniswaps and your compounds and all these things will need more permissioned environments to be able to run their smart contracts.

(00:44:08): They need to go where the liquidity is. And I think in an environment like the direct environment is going to bring sufficient liquidity for these types of projects to create value. So it's really been interesting to see how the direct project is really propelling the Brazilian ecosystem. It's like when you go to conferences here in Brazil and talking to people in the community, it's really, people are really interested in Drex and people are trying to find how can I implement my solution to work in the Drex network or how can we come up with new business cases that can be implemented inside or deployed inside the Drex network. So it is really, I feel like it's a really good powerful narrative here that's propelling things forward. And then just the fact that the government is not trying to kill the industry like it is in other places in the world is very, the government is really propelling the innovation here and really pushing it forward.

(00:45:05): And I think the fact that the central bank has such a strong track record of success when it comes to financial innovation regarding Pix and some other projects around open finance. And when we talk about government innovation, we don't usually think of this as this really amazing thing, but in the case of what the central bank has been doing the past 10 years, it's delivered real results and people are using these products and these services not because they have to, because they want to. And I think you'll have the same thing happen with direct where you'll end up seeing these benefits in the economy and all the various stakeholders in the end users will be using these products because they, they're beneficial at the end of the day.

Juliana (00:45:50):

Yeah, I actually completely agree with Alex and Aaron. I think it's extremely important to have the buy-in from local regulators such as the central bank and the CVM looking for the investment market as well. With that we certainly bring more robustness and also security for the market so the companies have more comfort to even deploy their own solutions in crypto. The crypto market has more infrastructure and know the rules to follow and unfortunately we have a division here because the increments of the crypto movement think that we shouldn't have the regulators, neither governments involved in the whole crypto market, but thinking very realistically if we want to bring mass adoption, it's extremely important to have the regulators by our side while we are building the whole ecosystem. Because in one hand, for example, the regulators are bringing a clear vision of how the company should operate, especially in Brazil and avoiding scans and companies that are trying to basically create permits to mass the whole ecosystem. But the regulatory on the other hand is also bringing their own projects like direct. And this is super relevant globally speaking, I think crypto is still a very new market for everyone, for us who are building internally for regulators, for companies, for banks, for everyone. So while we are structuring all that we are talking right now, we are actually learning while we are working from a them.

(00:47:42): So I think it's crucial to have regulators by our side during this journey and movement and very quickly about the permissioned projects, I think there's no problem at all actually. My vision is that in the future, of course not when the project kick off for the whole market, but in the near future it has to have interoperability between the public and private networks to extremely link and fulfil the needs that we're going to have in the near... I dunno, 5 to 10 years in the market. And one last point that I think it's important to mention is that the regulators, while they are structuring the rules, the laws, et cetera, they should move with the market and not on the opposite side of the market. So we should understand that crypto, it's a very new ecosystem, it has their own nuances, their own specifications. We shouldn't consider crypto market as traditional market as TradFi for example. So the regulators should also have this in mind while they are putting the laws and the rules for us the market should play and to follow. So I think these are some considerations that are important right now

Szymon (00:49:07):

To follow up on that, I really think that government engaging in blockchain based projects is going to encourage more usage. So there's probably going to be more companies considering building on chain and many of these companies could just choose to build on open public chains, which I hope is something that's going to happen. And at the same time I believe that people could just feel encouraged to use such solutions as they see that their government is entrusting this technology with some of the key fundamental infrastructure projects developed in Brazil. So this is very, very encouraging. I'm not very much interested personally in CBDC and built pieces of infrastructure. I'm mostly a web three kind of guy. I'm very excited about building alternatives to government built systems, but I can see a lot of synergies so we can learn from each other and at the same time, crypto technology advances is going help governments build better infrastructure and better infrastructure introduced by governments could lead to faster and better adoption in the future, which is I think a great virtuous cycle for us all.

Thiago (00:50:42):

Okay, we're approaching the end of the time that has been set and I've just posted a question so I will let you guys reply, if you can stay for longer or not. I think there's one important topic that we should discuss. It's really something that it's I think on top of mind for pretty much everyone in every country right now is how do we make this progress? How do we take this to the next million or billion people and what are the challenges that we are facing? And I guess in Brazil with all the seemingly support from the government, there are still a few traditional issues when it comes to developing an internal industry that prevents, and I can think of a few ones that just examples that come to mind when I think about building a project in Brazil. I think of the difficulty with brain drain with acquiring funding with bureaucracy and taxes and some vested interests. If you think about especially the cartorios and notaries and attestation and blockchain privacy and education to name just a few. I guess I don't want to be comprehensive here, I just name them to give a starting point and I want to hear from you guys, since you are on the ground, you're dealing with this on a daily basis, what are the key challenges that currently face Brazilian projects or people who are actually trying to build something in the country that you can identify?

Aaron (00:52:23):

I can go, I think there's probably two things that I would say. I think there's one issue which is it feels like there's the ratio of builders in Brazil to investors is it feels kind of off vis-a-vis other countries. And I feel like maybe phrase it differently, the number of people involved in crypto in Brazil are more in it for the investing and just as hedging or whatever. They're not necessarily building new projects. The number of Brazilian native projects feels there's fewer of these and there's fewer maybe web3 developers here than there are in other parts of the world you'd expect to see find more in a market of this size. So what I would like to see is more investment and time from both in resources and time and events and things from some of the larger web3 protocols into the Brazilian market.

(00:53:23): And obviously Alex and the Ethereum Brazil have really done a good job and there's a few others that have been investing some resources into stimulating this growth of this local developer community and local builder community. But I feel like by and large the market, I mean given the size and the potential of the market and just the creativity and Brazilians are just very creative, savvy people who just know how to find clever ways to find solutions to things, the market just feels very overlooked just on the global stage. And I think people just kind of instinctively look at Latin America as it's like, oh it's like financial inclusion and remittances and whatever, and it's not really, people aren't looking at Latin America or Brazil as like, wow, this is a place where we can really create a really strong base and a really strong base of users and builders and talent.

(00:54:21): So I feel like having more support from the global community, I mean it's really encouraging to see companies like Ramp Network, like you're hosting this session here, so obviously you guys see the potential here, but I feel like generally speaking on the global scale things are overlooked and I also just think there does tend to be, there's just a need for more education. There is a language barrier in Brazil, English isn't really universally very well spoken, understood. So there is just a lot of things that either get lost in translation or just don't get translated at all about what this technology is. So I think there's just a need for just more content, more education around just all aspects of the technology and what web3 is.

Juliana (00:55:12):

Yeah, I agree with Aaron. One thing that I would add to what he said is that Brazil is well known for a specific word that we call here in Brazil: Brazil costs, it's the cost to open business in Brazil. So we used to say that Brazil is not for amateurs because it's not easy at all sometimes to open a company. This can take an average one month and a half. And we are talking about Brazilians opening companies in Brazil. So we're not talking about borrowing coming to Brazil to truly develop a new market or a new solution. So we still struggle with some internal bureaucracies that are not in the hand to crypto itself, but to the markets, to the country and to some socioeconomic problems that I'm not going to mention, but make sense when we are looking from outside from this holistic view, how is the business environment here?

(00:56:16): But I agree, I also miss some builders in the country truly offering new solutions, new use cases. Sometimes we are very centric to investments, to exchanges, remittance, et cetera. And what I used to say when I talk with the market or with friends in general is that in my view, my projection is that the solutions and products that we are going to truly use in the future having blockchain as the backup technology are being built right now. So I would love to see more like the creativity that Aaron just said in Brazilians, basically Brazilians building for Brazilians to truly solve the problems that we have either, I dunno, lack of bank relations, bank democracy, or truly new financial products that can help democratise the whole financial market here for people that cannot afford, for example, to open a bank account in a top tier one bank.

Thiago (00:57:44):

I was in Ethereum Rio and I've seen quite a lot of new projects and a lot of things that they complain about is also lack of venture capital funding or any kind of funding that'll help 'em take off the ground and I'm really hoping that will change in the near future. I see a lot of potential and we all see a lot of potential in the country I guess. So I will move on to a few questions from the audience and I think I already got one in here. Brazil still has a massive immigration issue now. How is this affecting the country? Is Brazil lacking in crypto experts or developers and builders? Just the building up I think on what Juliana was saying is that the reason for the lack of Brazilian web three project is that the devs who build it are migrating elsewhere or is there any other problem?

Alex (00:58:48):

So I think I can answer that a little bit. So before I joined crypto, I think I thought that the only way that I could even really grow in my career would somehow to move out, and become an immigrant myself. And then crypto sort of changed that in a way because, and I see that with a lot of people where they suddenly are able to still live in Brazil and pay the Brazilian pay rent in Reals, but earn in dollars just being a crypto expert or being a crypto developer or, and I think that was very true even before the pandemic and now after the pandemic where remote work became such commonplace crypto really enables you to be able to work from anywhere and just be paid in crypto, be paid USDC and then you can very easily to exchanges. And I think that really that might help with the immigration issue in which all sort of experts who would otherwise believe in Brazil can still certainly just stay here and work for the outside and bring money. And I think that's very positive.

Thiago (00:59:58):

Yeah, I guess that the only issue with that is that you are always working for a company that's based elsewhere. And I guess the question was more about the Brazilian industry, but I think that the ability of crypto to enable making a living anywhere is quite remarkable.

Alex (01:00:16):

I've helped, I am helping some founders who were able to create a company in Brazil and then market their product outside, have investors from outside even hire German developers just because they can do all of that from Brazil because they don't actually need to. They can actually incorporate a company anywhere, but the main wealth is being created here locally and I think that is positive.

Thiago (01:00:48):

That's amazing. It's good to hear about that. There is another question about use cases and what are the strongest crypto use cases I guess in Brazil now and in the future? What are the perceived most effective use cases for crypto in the country?

Aaron (01:00:48):

I mean I think it really is the store of value. I mean just as we were discussing earlier with the medium of exchange and the transferring of funds at least domestically is not really a huge problem for people anymore just because of the existence of Pix where this has been around for maybe three years and I think something like 90% of the adult population uses picks now just to its instantaneous settlement settling transactions. And so because of that, the immediate of exchange is really, it's not really as prominent of a use case as it would be in other countries in the region like Venezuela for example. So you do really have the store of value hedge against inflation, hedge against the currency, hedge against uncertainty or whatever. Macro risk is really I think is probably the strongest use case right now. I mean more so than in other countries just because you don't have, chainalysis has actually done some pretty interesting research on this where they've kind of mapped out some of the different countries in the region and what are people actually using crypto for. And you can look at Venezuela and it's really overwhelmingly, or it's a strong percentage I should say of the use case people are using it for transferring, for actual payments. And in Brazil basically it's almost like non-existent for domestic payments anyway and it's really all more investing in store value use cases. You also do have an interesting GameFi scene here. I know that GameFi or Play to Earn has kind of fallen on hard times lately, but there is a lot of really interesting projects and entrepreneurs in this space. In Brazil, we actually just had a team that was in Singapore for Token2049 and Drex is the name of the team, but they were actually participating in one of the hackathons there and they actually got to meet Vitalik and Vitalik was really excited about the project and everything. So there is a lot of really creative stuff happening on that front that is still being built even despite the downfall of the play to earn or the current state of the play to earn market, which isn't great, but there is a lot of really interesting stuff happening on the blockchain gaming front here.

Thiago (01:03:44):

That's a very healthy trend. I guess the gaming is in what some people perceive as a holy grail for adoption. Let's see how that plays out. And I know personally somebody, a Brazilian guy has a web3 gaming startup. He's based in Brazil and the UK. So I guess I have one question as well and it would be a very appropriate one for Juliana. I've seen that the institutional adoption of crypto in the balance sheet or whatnot via the CNPJ has grown tremendously like 180% or so for the past year. And I know you are specialised in institutional and I was wondering what kind of businesses have been getting into crypto, do you have any insight into that that you could share? What kind of business and what are their interests around the space?

Juliana (01:04:44):

Yeah, so this is a very interesting question. So basically we have two trends. One, it's related to investments. So for example, we see a lot of treasury desks of banks truly trading crypto lately, and this is possible because we have more clarity right now. We have public companies for example, like Coinbase that can bring more, a little bit of transparency for these big banks to be comfortable to do that. And this is driving a lot of volume right now to the balance and to crypto movement when we're talking about cloudify. And also as I said before, we have the crypto as a service that some banks are starting to enter and we also have the Neobanks for example, as Aaron said, PicPay and new bank and MercadoPago that for two years ago they started already this movement to truly bring more mass adoption because basically they were seeing a lot of outflow of cash from their platforms going to exchanges to buy crypto.

(01:05:48): So it's a very clever way to stick with their clients and to truly offer the one-stop shop solution that you are basically saying that you can play in the market. So I think the reason why the volume within the institutions basically are migrating from one side to another. So we have the treasure desks and we also have the new offerings and not only crypto as a service, now we have the tokenization piece that are truly gaining hype and more products being created on that. So it's also important to have these into consideration when we're talking about the volume that we see right now.

Aaron (01:06:39):

If I could chime in on this one as well, this is also another question I've been trying to look into a bit more lately. It is a bit murky exactly who is doing what and what are they doing, but there's been some reporting around this in some of the mainstream crypto press that I thought was maybe a little bit inaccurate. They kind of framed it as like, oh, there's 90,000 companies in Brazil that are all like Michael Sailors holding Bitcoin and like, well I don't think it's mean a CNPJ, which is, it's basically an LLC essentially in the US it's not super difficult to open. I mean it's more difficult than it's in the US but it's not super difficult. A lot of people just have their own independent CNPJs. So as far as who is actually, I don't know necessarily that the guy running the coconut stand at the beach is holding Bitcoin in his business. I don't think it's necessarily something like that. But it is interesting that the number has just been going up only up into the right for the last 12 months as far as the numbers of these entities that have been reporting, holding or trading crypto or digital assets of some form. So it is something I'm definitely watching a bit more. I really want to try to find out who are these people and what are they using this for essentially why are they doing this?

Juliana (01:08:03):

Yeah, this is super relevant here. Let me just add one quick context about this. I was also very interested and keen to learn more about this and one thing that I discovered while you're talking to the market and with some companies is actually now that we have basically the rules from the local tax authority for the companies to basically report the crypto positions. One thing that was very interesting for me to learn is that some of the majority of these companies are actually buying ETFs not having a direct position with crypto. So they need to report that they have crypto at the end of the day, but it's not crypto itself. So it's a little paradoxical, of course that helps the market. But again, we should not take into consideration when we look the media saying that 10,000 companies have crypto under their balance sheet because there are some nuances under this red line.

Thiago (01:09:04):

Wow, thanks so much. It's really interesting and I think I could go on for how speaking each one of your brains, but I think we reached a point where we need to wrap up and maybe we'll do this again some other time. It's really our first foray in Brazil. It's been really, really interesting and appreciate your time so much. So with that said, I'll run around to you guys can offer your closing remarks, get two minutes for each so you can tell our listeners where they can find you and how they can get in touch if you're comfortable with that. So yeah, thank you so much again and you can get started again with Alex.

Alex (01:09:49):

Well first of all, thanks for invitation. In 2018 I left The Ethereum foundation and was focused on trying to have a startup, Trying to onboard the users and Ramp Network was very useful for that. I even believe I met Simon back then and it was a great partnership and well if you want to follow me, you can find me Twitter, I'm still there, unfortunately @avsa. Still excited about crypto. Thank you all.

Aaron (01:10:30):

Yeah, so my platform is Brazil crypto report. I have a substack, I have a podcast, I'm on YouTube, I'm exploring Instagram now. Brazilians love Instagram, so I'm having to learn how to use Instagram. And yeah, I'm really excited about this market. I still just view it as, I mean like I said before, it's like to me this is the most overlooked under-explored market in the world and I think people in this industry need to be paying more attention to Brazil to what's happening here. There's just a lot of momentum, especially given some of the uncertainty we're seeing in other countries. It's almost kind of shocking to me why people aren't paying more attention to this country. But I think it's just there's a lack of information, just a lack of knowledge. So appreciate Ramp Network and the team for hosting this just to help spread the word.

Juliana (01:11:22):

All right, Juliana. So once again guys, thank you so much for the invite and to be here alongside you guys for this fruitful conversation was a big pleasure. I'm not a Twitter girl, but I have an account they not very active, so the best way to reach out would be LinkedIn or through my email at BitGo. So basically JulianaWalenkamp@BitGo.com here to help. Thanks again

Szymon (01:11:51):

And I wanted to thank you all for coming. We have I believe today best offer for embeddable on Ramp Network for Brazilian companies building Web3 and trying to connect with the rest of the world and with global companies trying to get more Brazilians to use their product. Either way, come and contact us at Ramp Network, go to ramp.network and contact us and we're extremely bullish on Brazil and we are going to have even more product related updates that are Brazil-specific in the coming days.

Thiago (01:12:34):

Alright, thanks everyone. So with that said, just in case the contact details and everything about the guests will be posted alongside the video soon as we have it finalised and written. So don't worry about not getting the exact date. Appreciate your time. Thank you very much and let this be the First of many guys, have a great day and pleasure to have you. Thank you. Bye-bye. Thank you.

.png)

.jpg)