Here are 7 tips to help you pick an on-ramp to buy crypto safely.

Converting between fiat and crypto is much easier today than it used to be just a few years ago, largely thanks to the appearance of specialized crypto on-ramps and crypto off-ramps.

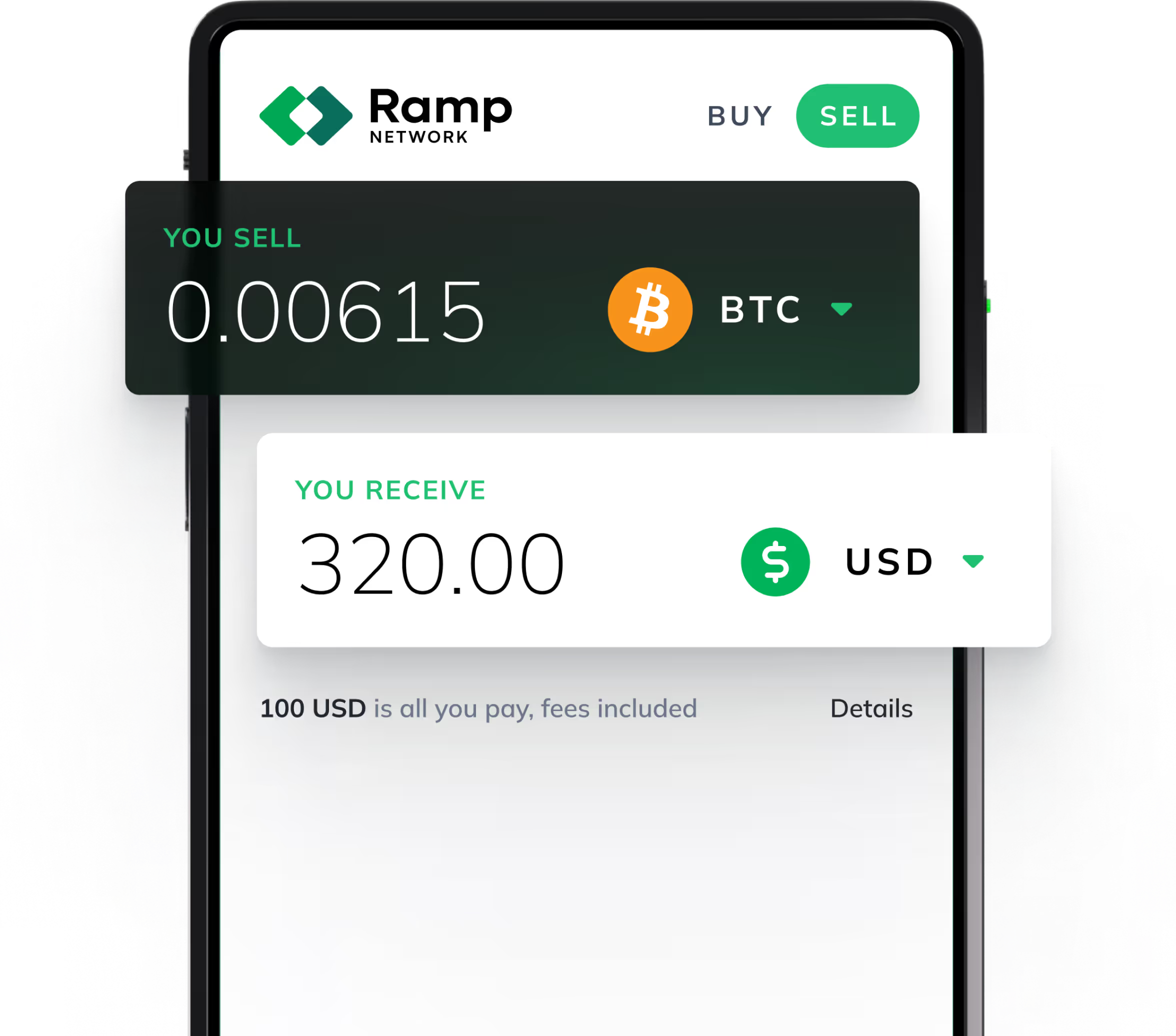

Crypto on-ramps are end-to-end solutions that let users move from fiat currencies to crypto in a single dedicated flow - while off-ramps work in the opposite direction, from crypto to fiat. Some of them (like Ramp!) also offer the option to integrate both on-ramp and off-ramp functionality into third-party applications, saving partners a costly overhead for onboarding new users.

Today there are dozens of players already in the on-ramp market, with new ones popping up every so often. And while most of them bring utility and innovation to the space, unfortunately not all of them operate under the same high standards.

From lackluster service, or compliance issues, to misleading pricing and hidden fees, choosing the wrong provider can turn what should be a smooth experience into a big headache.

So how to choose a crypto on-ramp while keeping your peace of mind?

Disclaimer

Before we start, a quick disclaimer. We’ve been in the on-ramping business for almost five years, so we’ve got skin in the game.

That said, the point of this article is to educate, not to convince you to use our services over anyone else’s. We’re also not naming names, but merely pointing out what we believe are the key things to look out for when choosing any crypto on-ramp service.

We believe that fostering trust between providers and users is a win-win for both parties, and for the Web3 space in general.

We’ll make every effort to remain as neutral as we can and let you be the judge of the result.

Without further ado, here are the 7 things to look out for when using a crypto on-ramp.

1. Look out for “dark patterns”

We all know about the problems with Web 2.0, let’s not let them port into Web3. While slick and shiny, many UXs are designed to make you forget, omit, or miss important information. This is a practice that has been described as the use of “dark patterns.”

In crypto on-ramp services, these tricks can look like inconsistencies in crypto quotes where hidden fees are added after an attractive price was presented to you. Look out for these fee changes and don’t be fooled by the “user-friendliness.”

Check that the price is consistent throughout your entire flow and that there aren’t “surprises” in the end.

2. Beware of hidden fees and price markups

The bane of bad marketing, hidden fees are unfortunately a prevalent practice across many industries - crypto included.

These fees are notably absent from the initial quote, and their purpose is to fool comparison/rate sorting mechanisms and to present a provider as having a better price than they really have.

They usually take one of the following forms:

- Checkout fee: a fee that’s added only at the end of a transaction, hoping that the effort users expended until that point will force them to go through with the purchase/sale. It’s usually obvious to users, and therefore less common.

- Network fee markup: a fee that’s unfairly marked up and presented as if belonging to the network (miner/validator) - for example, charging $3 when in fact the validation fee cost $1. This can be hard to spot, as it requires checking individual transactions on the blockchain after execution.

3. Watch out for excessive slippage

Slippage refers to the difference between the expected price of a trade and the price at which the trade is executed. This can happen for many reasons and, in theory, prices can trend both upwards and downwards.

Some slippage happens to every provider, in every transaction - and it’s mostly a natural (if unfortunate) phenomenon in any market.

Volatile markets such as crypto are naturally prone to it, and some common factors can have a big impact on slippage - such as:

- Using a slower-settling payment method

- Placing large orders

- Purchasing low-liquidity assets

- Transacting during high-volatility periods.

However, if even after controlling for those variables the executed price of a crypto purchase is consistently unfavorable, then perhaps there’s an issue with that service. Here are just a couple of potential reasons:

- Poor liquidity management: high slippage even for low-volatility periods and low-volume purchases may mean a provider isn’t properly managing their liquidity.

- Unfavorable timing: consistent, inexplicable delay in executing transactions leading to unfavorable prices may mean that a provider’s exchange system isn’t working effectively, or worse: that they’re being opportunistic when processing transactions.

There’s no cure for slippage, but you can mitigate its impact by using the fastest payment methods and using a reliable, technically sound, provider.

4. Check the blockchain for actual values

With blockchain technology, you have all the information you need on the crypto side of your transaction.

Once you’ve made a purchase, you can easily check its details and see if it all adds up. You should usually check:

- Exact value: check that the amount matches your receipt.

- Exact time of the transaction: to have a better idea of the cryptoasset’s true price at the time it was executed.

- Network fee value: the exact amount paid to the miner or validator to check for any discrepancies.

To check that, search for the transaction hash you received in a blockchain explorer that specializes in the cryptoasset you just bought, like Etherscan for Ethereum, or Blockchair for Bitcoin. Happy investigating!

5. Check reviews and ask others

Websites like Trustpilot are a good source of information on how a particular on-ramp treats its users (you can find Ramp Network's Trustpilot reviews here).

Neutral review sites are far from perfect, but beyond word-of-mouth from a friend, they’re the next best option to help customers make decisions. And there are a few things you can look out for to filter through the bots or noise, and get a truer picture.

Looking beyond just the overall rating can give you invaluable insight into how a given company works (or doesn’t). Also, most people are still getting a grip on Web3, so good customer service is paramount.

Here’s what you should look out for:

- Overall rating: the catch-all metric, while indicative of general quality it may mask hidden insights (good or bad).

- Number of reviews: fewer than a thousand reviews might skew results or signal selective reviews.

- Type of votes: in the absence of written review, the extremes of the scale (five stars or one star) can be less helpful, as they tend to be default for good/bad experiences; middling ratings can be a sign of a more thorough review.

- Complaint frequency and cause: repeated complaints around a topic might signal either mismatch of expectations (common in a new/complex market like crypto) or a company’s lagging response to issues.

- Company responses and resolution: a company’s proactive responsiveness to user reviews and the resolution of problems is a great trust signal.

6. Look for hacks and security history

Web3 is still arguably in the early days. Security is very much a real concern, as the eye-watering volume of high-profile hacks shows.

Before using an exchange or crypto on-ramp service, it’s not a bad idea to go through their history and look to see if they’ve been hacked before.

Having been hacked in itself shouldn’t be a dealbreaker, especially for companies that are at the bleeding edge of crypto. Many legit and solid projects have been hacked before, only to emerge better and stronger.

So, beyond just the hack, here’s what you should ask:

- What was the cause of the hack? Was it the company’s fault, or some other party's? Was it human error or technical? Zero-day exploits are painful but understandable. Sloppy, lazy, repeated, or outright dishonest mistakes raise a red flag.

- What was the response from the company? Have they communicated clearly, owned it, fixed it, and tried to make good to their users? Did they make excuses and deflect guilt? Or worse, have they refused to acknowledge it or gone missing?

- What measures have been put in place to avoid new hacks? Did they tackle the root cause of the problem? Or have they just swept it under the rug? Have they communicated effectively?

Security is of extreme importance to us. Amidst the not-so-few hacks in the crypto industry, we count ourselves among those who haven’t yet suffered a security breach - and we do our utmost to keep it that way.

7. Compliance with regulations

In this day and age, the crypto space is becoming increasingly subject to rules and regulations across the globe.

Individuals and businesses that don’t comply with these regulations face potentially severe consequences, ranging from hefty fines to criminal charges.

Before you use a service you should always check if the provider is allowed to operate in your country or state.

Using a locally compliant and authorized provider is a crucial step to buying or selling crypto without running afoul of your local laws.

This is why wide coverage is such an important priority for us. We take pride in being able to onboard partners and on-ramp users from over 150 countries and regions across the globe.

Choose well and stay safe

You’ve just seen seven tips that may help you avoid the most common pitfalls when choosing a crypto on-ramp to buy cryptocurrency.

This list is by no means exhaustive, so you should always keep a vigilant eye. Always do your own research.

Are you looking to purchase crypto safely? We got you covered. Just head to our Buy crypto page!

Would your company like to offer your users an easy and safe way to access Web3? Learn how you can partner with us and apply for a partnership.

.png)

.jpg)